Understanding this distinction is important because it gives insight into a company’s potential for future dilution (which we’ll discuss later). The Dividend Discount Model (DDM) is instrumental in common stock valuation, especially for investors interested in predictable income streams from dividends. The primary distinction between preferred and common stock is that common stock grants stockholders voting rights, while preferred stock does not. As a result, preferred shareholders get dividend payments before regular shareholders since they have a preference over the company’s income. The issuance of common stock cannot be more than the authorized number but can give less than the number of authorized shares. For example, the company issued 2000 shares during a public offering.

Analyzing Common Stock in Investment Decisions

Calculating common stock is a straightforward but vital task for understanding a company’s equity structure. By mastering this calculation, you can make informed financial decisions and gain deeper insights into a company’s value. This information is essential to financial literacy, regardless of your role as an analyst or investor. Another key difference between common stock and preferred stock is that preferred stock is affected by interest rates. On the other hand, the supply and demand of the market determine common stock prices. When people think about investing in a company, common stock is a big deal.

Understanding Price-to-Earnings (P/E) Ratio

This includes the issuance of new shares, stock repurchases, and stock splits. They ensure that these transactions are accurately reflected on the balance sheet, specifically in the equity section. Retained earnings represent the cumulative net income of the company, less any dividends paid out to shareholders.

At its core, common stock signifies basic ownership in a corporation. When you purchase common stock, you are essentially buying a piece of the company. Valuing Common Stock is the practice of determining the intrinsic worth of a stock based on its expected future earnings.

Treasury Stock Impact

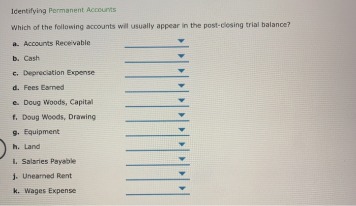

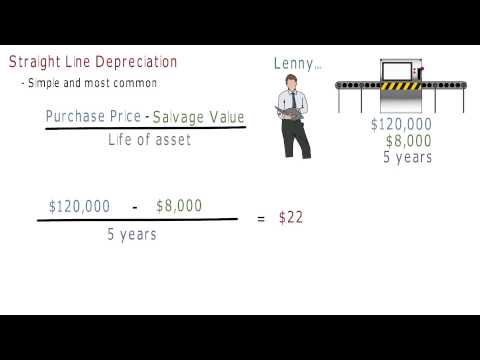

Their role is to verify that the financial statements are free from material misstatement and are presented fairly in accordance with applicable accounting standards. They also are frequently involved in dividend policy decisions and other strategic activities that directly affect common equity. Strong internal controls are essential to preventing errors and safeguarding the company’s assets. They ensure that financial reporting complies with accounting standards and regulations. They implement systems and procedures to track and monitor these transactions depreciation effectively. Authorized shares represent the maximum number of shares a company is legally permitted to issue, as specified in its corporate charter.

Understanding the Value of Common Stock in Financial Reports

It provides insight into company performance, investor sentiments and market trends. Critical to the investor’s decision-making process is the process of common stock valuation. Getting acquainted with the detailed steps for calculating the intrinsic value can equip you with the skills to make informed judgments and enhance your investing acuity. For simplicity’s sake, let’s take a delve into the Discounted Cash Flow(DCF) method – a common approach towards stock valuation. After establishing the concept of common stock and par value, let’s now delve into common stock valuation techniques. These methodologies enable market participants to assess a company’s intrinsic value and predict future movement in the stock’s price.

Should You Invest In Common Stocks?

Selling preferred stock, like any other shares, lets a company raise money by selling a stake in the business. A company may do this to raise capital for business expansion, debt repayment, or to invest in new projects. This guide promises to enhance your understanding of these crucial components of business studies. It will illuminate often complex concepts such as the calculation of common stock value, offering hands-on examples.

ROE measures a company’s profitability relative to shareholders’ equity. The common equity ratio, calculated as total common equity divided by total assets, indicates the proportion of a company’s assets financed by common equity. However, a large number of unissued shares can also dilute existing shareholders’ ownership if they are issued without proper consideration for shareholder value. In conclusion, common stock is not merely a financial instrument; it is a fundamental element of corporate ownership, finance, and governance. A solid grasp of its principles unlocks a deeper understanding of the corporate world. Valuing common stock refers to determining the intrinsic worth of a stock based on its expected future earnings.

While stock splits and reverse splits don’t inherently change a company’s underlying value, they can influence the share price in the short term. A stock split is often perceived positively by the market, as it signals management’s confidence in the company’s future prospects. This positive sentiment can lead to a temporary increase in the share price. Conversely, a reverse stock split is the opposite – it’s like combining several pizza slices into one larger slice. A 1-for-10 reverse split means that every 10 shares an investor owns are consolidated into 1 share.

While this means common stockholders bear more risk, it also offers the potential for higher returns if the company performs well. Stocks are the share of a company that can be purchased by anyone who wants to invest in the corporation. A corporation sells its shares in order to make money from the individuals so that it can invest this money in the further progress of the corporation. In replacement, the company provides voting rights to the stockholders and the dividends when it is issued.

- Conversely, when a company reissues treasury stock, it increases the number of outstanding shares.

- Learn how past performance can offer valuable insights into future common stock movements.

- Because common stocks are publicly traded, practically anyone can invest in them.

- Common stock is the “default” type of stock, but it’s not the only type.

- Book value per share represents the equity available to common shareholders on a per-share basis.

FAQ: Your Grow a Garden SUMMER UPDATE Questions Answered

Conversely, a stock trading significantly above its book value suggests that investors have high expectations for the company’s future performance. The Basic EPS we just discussed only considers shares currently outstanding. But what about those stock options, warrants, and convertible securities? These represent potential shares that could be issued in the future, and they have the potential to dilute the earnings available to existing shareholders. You might stumble across the term “par value” when researching stocks. Historically, par value represented the minimum price at which a share could be sold when initially issued.

Due to their fixed dividends and lower risk profile, preferred stocks typically have less price volatility and greater growth potential than common stocks. Because of their stable dividends and lower volatility, preferred stocks are often favored by institutional investors pursuing a predictable income stream. Calculating common shares involves understanding the various components that make up a company’s equity. The total equity is determined by adding the value of common stock, preferred stock, additional paid-in capital, retained earnings, and treasury stock.

Ever wondered how much say someone really has in a company, beyond just owning a few shares? It’s not always as straightforward as simply looking at the number of shares they hold. Calculating ownership percentage delves into the mechanics of shareholding and its implications for control and influence.

- If the company fares poorly, both types of stock are likely to produce losses.

- Compliance with regulatory requirements is crucial for maintaining investor confidence and avoiding legal penalties.

- The Basic EPS we just discussed only considers shares currently outstanding.

- Investing in common stock means you’re putting your money into a part of the company’s journey.

- This information is essential to financial literacy, regardless of your role as an analyst or investor.

They can either be company promoters, insiders, or outside investors. Monitoring changes in the number of issued shares is crucial because it directly affects key financial metrics like earnings per share (EPS). An increase in issued shares (without a corresponding increase in net income) will dilute EPS, potentially impacting the stock’s valuation.