This level of education provides the prerequisites to sit for the CPA exam, including coursework in accounting and business. A few accounting careers, such as personal financial advisors and payroll clerks, also pay relatively close to national averages. Arkansas also pays personal financial advisors similar salaries as Texas, Ohio, and Florida.

What are the requirements for a CPA Certification?

Degree-seekers who work full time may prefer a hybrid format for scheduling flexibility. Online accounting programs generally apply the same curriculum and expectations as on-campus programs. However, online students must remain self-motivated and able to learn concepts without as much instructor guidance.

States with Higher Salaries for Cpa

Arkansas is also home to the unique Arkansas Scholarship Lottery, which has awarded over $4 billion in scholarships since 2009. The state also provides an easy-to-use scholarship search tool to help degree-seekers fund their education. With one of the country’s lowest cost of living indexes, Arkansas offers an affordable option for many aspiring accountants. Accounting students who prefer a blend of online and on-campus learning can consider hybrid delivery. These programs require learners to attend classes on campus at least part time.

School Info by State

To sit for the Arkansas CPA exam, each applicant must have a bachelor’s degree. An accounting or business administration degree in Arkansas that satisfies this requirement typically takes four years to complete. The processing time for the CPA application may take about four weeks, but students can sit for the exam once approved.

- HLC currently accredits Arkansas State University and the University of Arkansas, both of which offer accounting programs.

- Schools with Arkansas accounting programs may most commonly be accredited regionally by the Higher Learning Commission (HLC).

- A bachelor’s degree is typically required for the role, but some compliance officers may also pursue certifications to advance their careers.

- If you don’t mind desk work, managing others, or thinking creatively about money and taxes, then becoming a CPA might be the right career choice for you.

- Students in more rural areas might find that online programs allow them to attend school without a long commute.

- Accountants in Arkansas typically begin their careers by pursuing an accounting or business administration degree in the state.

Accountant earnings by seniority

Together, these educational requirements must equal at least 150 credit hours. Explore potential accounting careers and Arkansas employment trends below. In a primarily rural state like Arkansas, the in-person connections with peers and instructors made in on-campus programs can offer an invaluable networking boost. The following information offers additional considerations as you decide the best pathway for your future accounting career in Arkansas. If you don’t mind desk work, managing others, or thinking creatively about money and taxes, then becoming a CPA might be the right career choice for you. To become a full member of AICPA, the applicant must hold a valid CPA certificate or license from at least one of the fifty-five U.S.

Which city pays a higher Cpa salary in AR?

Learners can also save on tuition by taking advantage of state reciprocity agreements, which allow out-of-state learners to qualify for Arkansas in-state tuition. For example, the University of Arkansas gives in-state tuition to students from Texas’ Texarkana and Bowie County areas. The breadth of key industries in Arkansas, such as retail, transportation, cpa salary arkansas and food processing, creates a solid foundation for various types of accountants to find work. Patient billing specialists, financial analysts, and audit and reimbursement specialists are among the most in-demand positions for Arkansas accountants. Salary.com job board provides millions of Accountant I information for you to search for.

Some follow a linear career path within one field, while others change fields periodically to achieve career or personal goals. First-time applicants taking the CPA exam in Arkansas pay an initial fee of $50. Test-takers must also pay $238.15 for each of the four sections as contract examination provider fees.

Arkansas schools typically reserve the lowest tuition rates for in-state learners. Explore this guide for accounting requirements, what pursuing an accounting degree in Arkansas looks like, and accounting employment data for the state. Featured or trusted partner programs and all school search, finder, or match results are for schools that compensate us.

Accreditation indicates that colleges and universities adhere to rigorous quality academic standards. Arkansas schools and programs may receive institutional or programmatic accreditation. However, a higher percentage of students in Arkansas are enrolled in distance education compared to the national average. The average salary for an accountant in Arkansas is around $61,770 per year. A career path is a sequence of jobs that leads to your short- and long-term career goals.

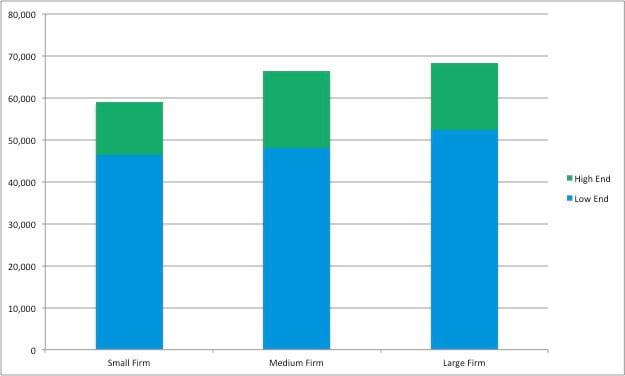

A state’s cost of living also plays an important role in the total cost of a degree, as many learners must also budget for essential costs while attending school. As you begin your accounting education, consider the differences between on-campus, online, and hybrid programs, along with how they fit your learning style. Choosing a school and accounting program is a big step, and you might wonder if Arkansas is the best place to start your education. Degree-seekers have several options when paying for college, navigating possible concentrations, and choosing learning formats. As of November 01, 2024, the average annual pay of Accountant I in AR is $57,710. While Salary.com is seeing that Accountant I salary in AR can go up to $68,722 or down to $47,903, but most earn between $52,577 and $63,474.

After passing the exam and becoming licensed, each licensee must take one hour of ethics training through the ASBPA and three additional hours of ethics every three years. They also need to complete at least 40 continuing education credits within the year before their license expiration date. Every state has specific requirements for CPA initial licensure and renewal. The Arkansas State Board of Public Accountancy (ASBPA) oversees Arkansas accounting requirements for CPAs. Still, the Big Four accounting firms have a presence within Arkansas, particularly in the Bentonville and Little Rock metropolitan areas. Bentonville ranks second in Arkansas’ best places to live by the Chamber of Commerce for its healthy economy, mix of Fortune 500 companies, and high-paying jobs.