We’ve ranked the best self-employed accounting software, and QuickBooks is at the top. But with the right accounting or invoicing software for small businesses, filing tax information can be a simple and streamlined process. QuickBooks makes this process even easier thanks to a huge range of integrations and plug-ins you can use, with familiar names such as PayPal, Shopify and MailChimp all present and accounted for.

To manage payroll through QuickBooks Payroll, you’ll need to pay a fee for this add-on service, with plans ranging from $45 to $125 per month, plus an additional $5 to $10 per employee per month. Although you can track expenses, QuickBooks Simple Start doesn’t enable users to pay bills. If you don’t need accounting just yet, our new money solution offers banking, payments, and 5.00% APY—all with no subscription or starting fees.

Sick of missing invoices and other data in QuickBooks?

For Xero’s Early plan ($13), the number of invoices that users can send each month is capped at 20, but for all other Xero plans, users can send unlimited invoices. QuickBooks Online is one of the preeminent cloud-based accounting software platforms on the market. With four plans available, there are several options from which to choose, depending on your needs.

Our Methodology: How We Evaluated QuickBooks Online Pricing

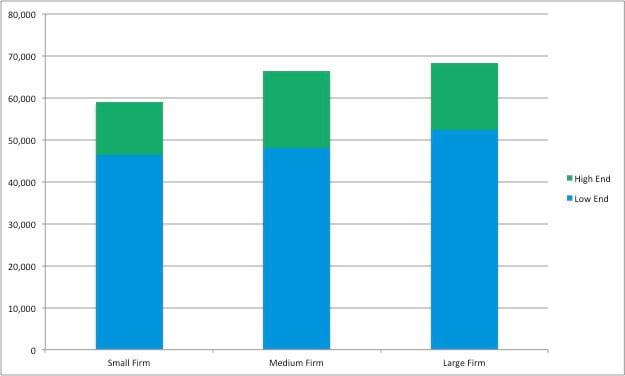

There are also a few kinks in how the software is organized, and the software can be a little expensive, especially if you upgrade to the Advanced plan for more features and users. However, what is the average the sheer number of features and strong accounting still make QuickBooks Online a good option for small businesses. While your QuickBooks Online plan includes most of the features you’d expect from accounting software, there are a few additional add-ons available. QuickBooks Payroll is one of the most popular, with prices ranging from $50/month + $6/employee – $130/month + $11/employee. Although it has the lowest starting price, at $12 per month, it can be a little more difficult to navigate than QuickBooks or FreshBooks. Because there is an unlimited number of users that can use the program, you can maximize its use if you have a team of professionals who need access to your accounting software.

If you have five employees who need to track time and only two who need access to other features in the software, you can still use the Essentials plan without upgrading to the Plus plan. Whether you use QuickBooks Payments or another payment gateway, be sure to take potential credit card fees into account when calculating how much you’ll be spending on software each month. Most integrations come with monthly subscription fees, so be sure to account for these extra costs when calculating your total costs for QBO. QuickBooks now offers a free small business checking account called QuickBooks Checking (formerly known as QuickBooks Cash).

QuickBooks Online vs QuickBooks Desktop

If you invoke the guarantee, QuickBooks will conduct a full n evaluation of the Live Bookkeeper’s work. There is no need to download QuickBooks Online because it is connected to the cloud, which means you can access online accounting from any device with an internet connection. You can download the QuickBooks Online mobile app from the Google Play Store or Apple App Store. Its two-way, real-time sync with every QuickBooks version tackles the jobs humans can do, but don’t want to. Note that if you’re looking for ERP (enterprise resource planning) software, QuickBooks Enterprise is an effective alternative with the right apps.

- You also get access to exclusive premium apps such as LeanLaw, HubSpot, DocuSign, Bill.com, Salesforce, and more.

- QuickBooks Enterprise, then, will be the only remaining desktop solution.

- Live bookkeepers aren’t responsible for errors resulting from incorrect information that you provide, or if you re-open the books by overriding closure after a Live bookkeeper completes the month-end closure.

QuickBooks Online Customer Service

It may also be a more affordable option provided you don’t have many users, as FreshBooks charges an additional fee per user. When it comes to features and integrations, QuickBooks Online and Xero are pretty evenly matched. However, Xero has a few advantages because it supports unlimited users at no additional cost, making it a solid choice for larger businesses. While all plans include basic accounting features, you can upgrade your plan for more advanced features. These include time tracking, project management, inventory management, budgeting, and more.