Escrow account ledgers, which track funds held in trust on behalf of clients, do not fit directly into the financial statements discussed above. This is because these funds are not considered part of the law firm’s assets, liabilities, or equity. However, managing escrow accounts is a critical aspect of a law firm’s financial responsibilities. It is crucial to track client funds held in escrow and any disbursements made https://www.bookstime.com/ from these accounts with precision and transparency. Creating an accurate, detailed legal chart of accounts is an important tool to give you an accurate picture of where your firm’s financials stand.

Trust liability accounts

Paul Garibian is the president of Nota, M&T Bank’s fintech platform that provides business banking solutions for attorneys managing solo and small law firms. To successfully manage and grow your practice, you need to invest considerable resources in your firm’s finances. Equity represents contribution margin the owner’s residual interest in the firm’s assets after deducting liabilities. In our sample, the owner’s equity consists of the owner’s capital contributions of $200,000 and retained earnings of $25,000, totaling $225,000. Retained earnings are profits that have been reinvested in the business rather than distributed to the owner(s). The Supreme Court has authority to appoint a successor signatory for the attorney trust account.

How to choose an accountant for your firm

- And a lack of professionalism can lead to losing your clients, referrals, and growth opportunities.

- Decide early on how you plan to complete bookkeeping tasks, how often you plan to do financial reporting, and how you’d like to manage financial records and documents.

- Now that we have the basic financial concepts down, there’s one more point worth hitting now before we dig into details.

- It’s essential for law firms to be aware of information reporting requirements and special issues affecting multinational firms.

- Managing the finances of a law firm involves keeping track of both revenue and expenses.

- You can use your cash flow statement to understand why you’re not generating a cash surplus from your business activities.

- Interest income encompasses the interest that a company earns from its interest-earning cash balances.

With so much to consider and plan for, we created a guide to preparing for lawyer retirement. This guide contains stats on the average lawyer retirement age, ethical considerations, best practices for preparing financially, and more. Your firm can increase cash flow by using time-saving features offered by industry-leading legal payments software. For example, perhaps the family law lawyer receives ample requests for virtual consultations from working parents. However, they’ve expressed that the WiFi isn’t strong enough to support these calls.

IOLTA Guidelines

It’s essential for law firms to be aware of information reporting requirements and special issues affecting multinational firms. Compliance with tax regulations includes not only filing a timely tax return but also providing necessary documentation and maintaining transparent financial records. Managing the finances of a law firm involves keeping track of both revenue and expenses.

Plus, most small and solo law firms maintain their books on a cash basis. This means you should not include the biggest accounts at one particular time on the balance sheet. Profitability analysis is a common practice in cost accounting and law firm financial management.

What to look for in a legal bookkeeper

For example, if there’s a lot of overtime, does it make more sense to hire a part-time person instead of paying the overtime? Or does it make sense to move up to a group benefit plan where law firm chart of accounts HR is included, taking the onus of HR compliance off the firm and lowering costs? Evaluating payroll is one of the best ways to better control expenses,” Artesani explains.

- All these tasks require attention to detail and a deep understanding of the legal industry’s unique requirements.

- However, accounting is a necessary part of the profession that helps ensure your firm is profitable, your team is fairly compensated, and your accounts are compliant.

- MyCase provides trust account reports so you can reconcile your firm’s trust retainer accounts — and remain compliant with state law.

- If you’re required (or would like to) set up an IOLTA trust account, double-check that you’re setting up the correct account with your bank.

- Ethics rules vary in each jurisdiction, but there are definitely some basics when it comes to accounting for law firms.

- In fact, our 2024 Legal Industry Report revealed more than 1 in 10 lawyers and legal professionals cite law firm accounting as the most challenging function their firm faces.

Use financial reporting to identify opportunities

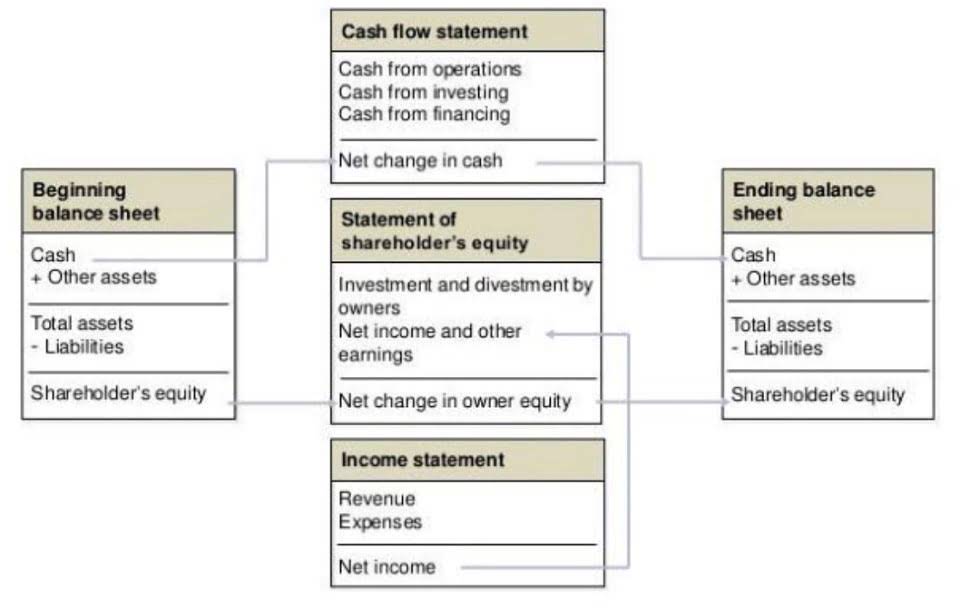

In simplest terms, financial reporting involves tracking, analyzing, and reporting your firm’s income. Generally Accepted Accounting Principles (GAAP) are standards outlined by the United States Financial Accounting Standards Board (FASB). The GAAP acts as a set of guidelines for companies to prepare their financial statements, such as the ones below. Regardless of which option you choose, your firm will require some kind of payroll system. This is integral for following accounting and bookkeeping best practices. Additionally, working with a legal accountant to set up your initial payroll—especially when it comes to paying yourself—is the best way to prevent any surprises come tax season.

- Another benefit of comparing balance sheets is that you can determine how much a business has grown over different points in time.

- However, additional payment methods and legal payment processors lead to more compliance requirements.

- Because InvoiceSherpa integrates with Clio, you can bring contacts and invoices from Clio directly into InvoiceSherpa.

- The payment of a simple utility bill demonstrates this process in action.

- They are a natural starting point in determining the profitability of services at your firm.

- InvoiceSherpa supports accounting for law firms by saving you time and energy, increasing your cash flow, and getting invoices paid faster.

The importance of cash flow

Learn more about the benefits of adopting evergreen retainers at your law firm. We’ll go over the cash and accrual accounting along with the pros and cons of both below. Net income is derived by taking the earnings before tax value and subtracting tax expenses. When it comes to key accounting concepts, it’s really about organization.

Trust interest payable

These include the balance sheet, profit and loss (P&L) report, and income and cash flow statements. Packed with business intelligence and key financial insights, these reports help you better assess business sustainability and risk. They identify potential issues ahead of time—such as cash shortfalls, delinquent accounts, and unnecessary expenses. Understanding and interpreting your law firm’s financial statements is key to making informed, strategic decisions that drive success and growth. If you need expert guidance on interpreting and leveraging financial statements tailored to your law firm’s unique needs, Law Ledgers is here to help.